AI-Powered PDNob PDF Editor

Smarter, Faster, Easier PDF Editor Software

AI-Powered PDNob PDF Editor

Edit & enhance PDF with Al

Managing payroll efficiently is essential for businesses of all sizes. An ADP pay stub template helps employers generate detailed pay statements that include earnings, deductions, and net pay. These templates ensure accuracy and compliance with payroll regulations. Whether you're a small business owner or an HR professional, understanding ADP pay stubs can simplify payroll processing.

This guide explores ADP paycheck template, their types, and how to create one while ensuring authenticity. Read on to learn everything you need to know about using ADP pay stub templates for easy payroll management.

An ADP pay stub template is a standardized document that provides a detailed breakdown of an employee’s earnings. It includes key components such as gross pay, deductions (taxes, benefits, etc.), and net pay (final take-home amount).

Companies use ADP for payroll processing because it automates calculations, ensures compliance with tax laws, and provides secure, professional pay stubs. Unlike regular pay stubs, ADP paycheck template are pre-formatted for accuracy, integrating easily with payroll systems to minimize errors and improve efficiency.

ADP pay stub templates come in multiple formats, each catering to different payroll needs. Here are the main types:

Businesses can choose from different formats depending on their payroll process and preference. These templates help ensure accurate calculations, compliance, and proper record-keeping.

A printable and secure format, ideal for maintaining official payroll records.

An editable template with built-in formulas that automate payroll calculations, reducing manual errors.

A flexible and customizable template, allowing businesses to manually enter and adjust payroll details.

This template auto-calculates earnings, deductions, and net pay, simplifying payroll processing for small businesses.

An ADP pay stub generator helps businesses quickly create accurate pay stubs. It simplifies payroll by calculating earnings, deductions, and net pay instantly. Some top ADP pay stub generator tools include:

Features of Top ADP Pay Stub Generators

A free ADP check stub maker helps small businesses manage payroll efficiently without extra costs. It ensures accurate record-keeping by calculating wages, deductions, and net pay automatically.

Some platforms offering ADP pay stub template generator with calculators include:

An ADP pay stub calculator helps compute earnings, taxes, and deductions to determine net pay. Employers and employees can use it to verify payroll accuracy.

How to Calculate Earnings, Taxes, and Deductions

Difference Between a Pay Stub Generator and a Paystub Calculator

Gather Employee & Employer Information

Collect the employee’s name, address, and Social Security number. Add the employer’s name, company address, and tax details.

Enter Pay Period & Earnings

Specify the pay period start and end dates. Input hourly rate, hours worked, overtime, and bonuses.

Calculate Gross Pay

Multiply hours worked by the hourly rate. Add overtime and any additional earnings.

Deduct Taxes & Withholdings

Subtract federal, state, and local taxes. Deduct Social Security, Medicare, and any pre/post-tax contributions.

Determine Net Pay

Subtract total deductions from gross pay. The remaining amount is the employee’s take-home pay.

Review & Save the Pay Stub

Double-check for accuracy. Download, print, or email the final pay stub.

An ADP pay stub calculator simplifies payroll by estimating earnings, taxes, and deductions. It ensures accuracy and compliance before issuing paychecks.

Inconsistent formatting with misaligned text and blurry fonts

Rounded or even figures instead of precise amounts

Missing company details like employer name and tax information

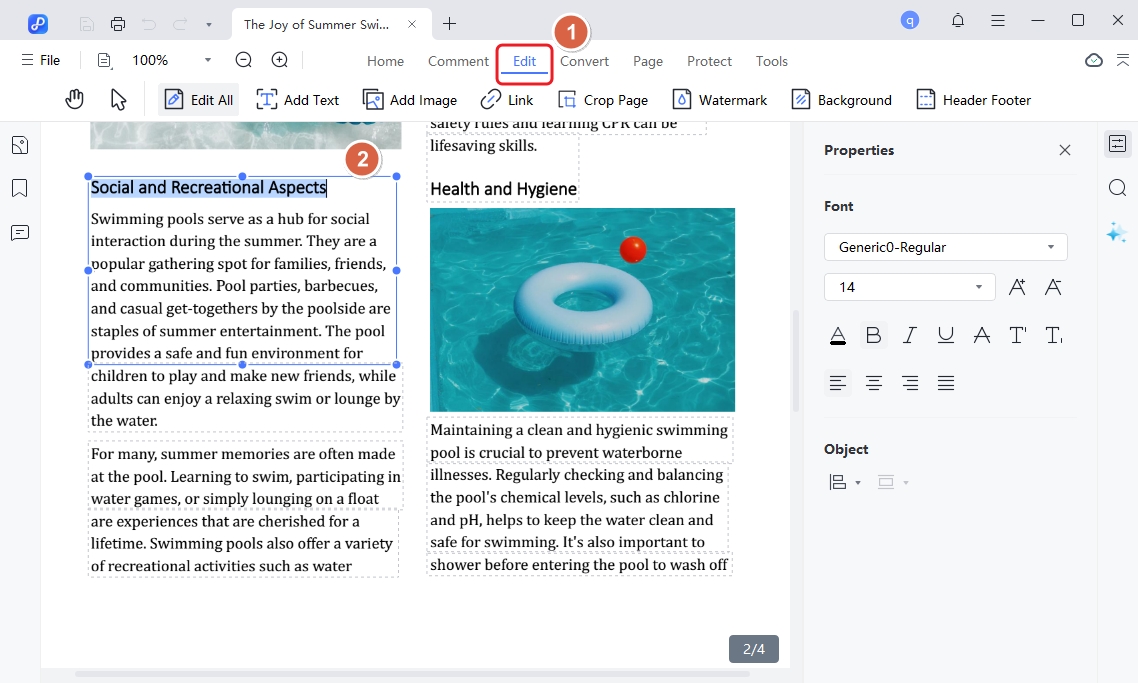

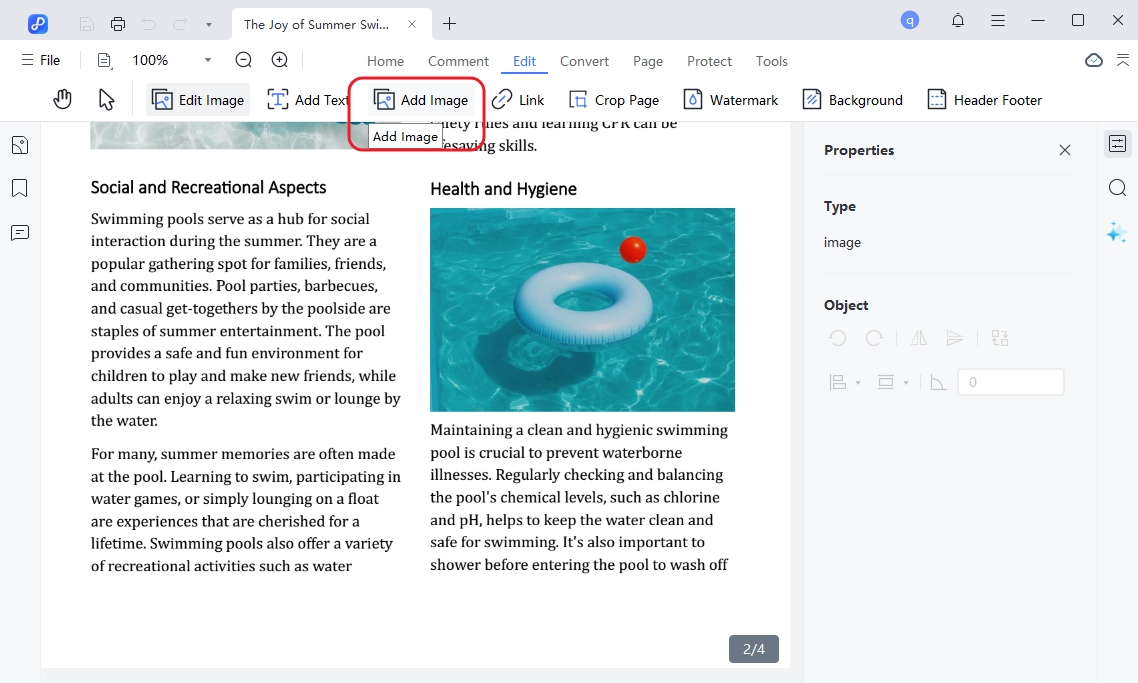

Managing and editing ADP pay stub templates can be challenging without the right tools. Tenorshare PDNob simplifies this process by allowing users to edit, annotate, and convert pay stub PDFs effortlessly.

Whether you need to modify employee details, adjust earnings, or extract text from scanned documents, this tool provides a easy experience. With its OCR feature, you can convert images into editable text, making record-keeping easier. Additionally, PDNob PDF Editor supports multiple file formats, ensuring compatibility with Excel, Word, and more.

An ADP pay stub template is essential for accurately recording employee wages, deductions, and net pay. To make the process even easier, Tenorshare PDNob is a reliable tool for managing and editing pay stub PDFs. It allows you to modify details, convert files, and extract text effortlessly. With its advanced features, you can efficiently handle pay stubs while maintaining accuracy and security.

PDNob PDF Editor Software- Smarter, Faster, Easier

then write your review

Leave a Comment

Create your review for Tenorshare articles

By Jenefey Aaron

2025-04-14 / Knowledge

Rate now!