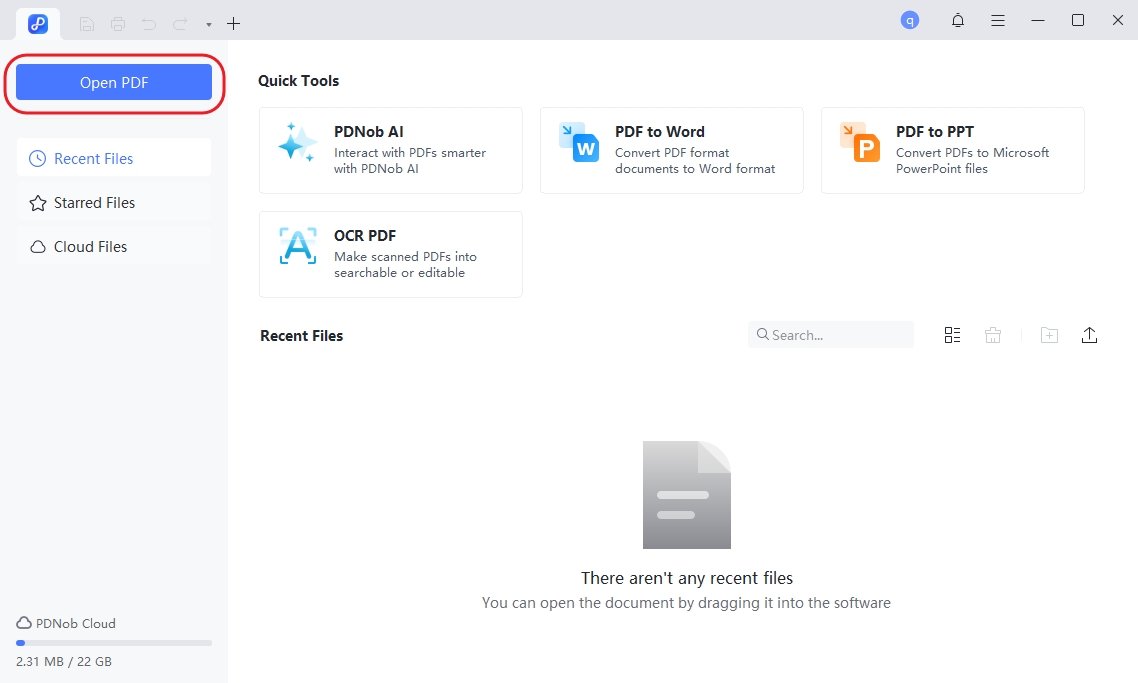

AI-Powered PDNob PDF Editor

Smarter, Faster, Easier PDF Editor Software

AI-Powered PDNob PDF Editor

Edit & enhance PDF with Al

What is a contract of adhesion in insurance, and how can I protect myself from unfair terms?

A contract of adhesion refers to a standard, non-negotiable agreement typically drafted by one party, leaving the other party with little to no room for modification. This type of contract is common in industries like insurance, where consumers are often presented with “take it or leave it” terms.

In this article, we will explore the risks and rights associated with what is contract of adhesion in the insurance industry, shedding light on their enforceability, key examples, and ways to protect you.

An adhesion contract is a standardized, non-negotiable agreement where one party, typically in a stronger bargaining position, imposes terms on the other party, who has little to no ability to modify them. These contracts are commonly found in industries like insurance, leasing, mortgages, and consumer credit.

Courts may scrutinize adhesion contracts under the doctrine of reasonable expectations and unconscionability to ensure fairness.

Contract of adhesion are generally enforceable under most legal systems, but the enforceability is subject to certain conditions. Courts tend to uphold these contracts if the terms are clear, reasonable, and the agreement was made in good faith. However, there are exceptions to this rule.

In insurance disputes, courts often find that adhesion contracts are enforceable as long as the terms are transparent and both parties understand them. However, if the insurance policy contains hidden clauses or unfair exclusions, a court might rule the contract invalid or unenforceable.

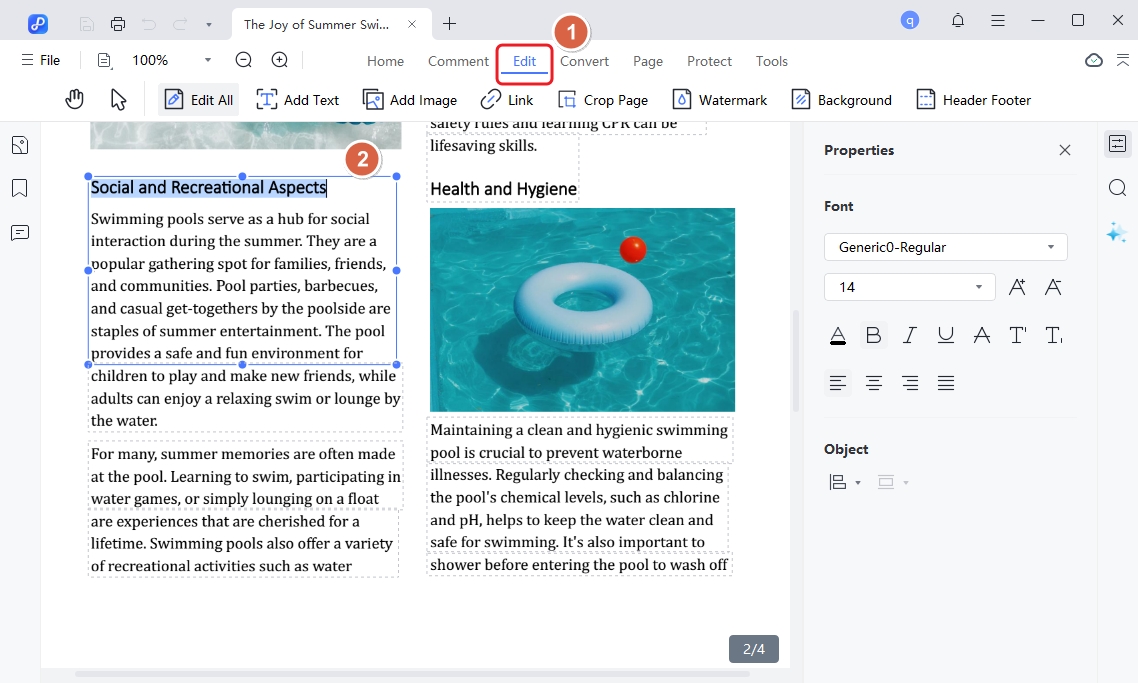

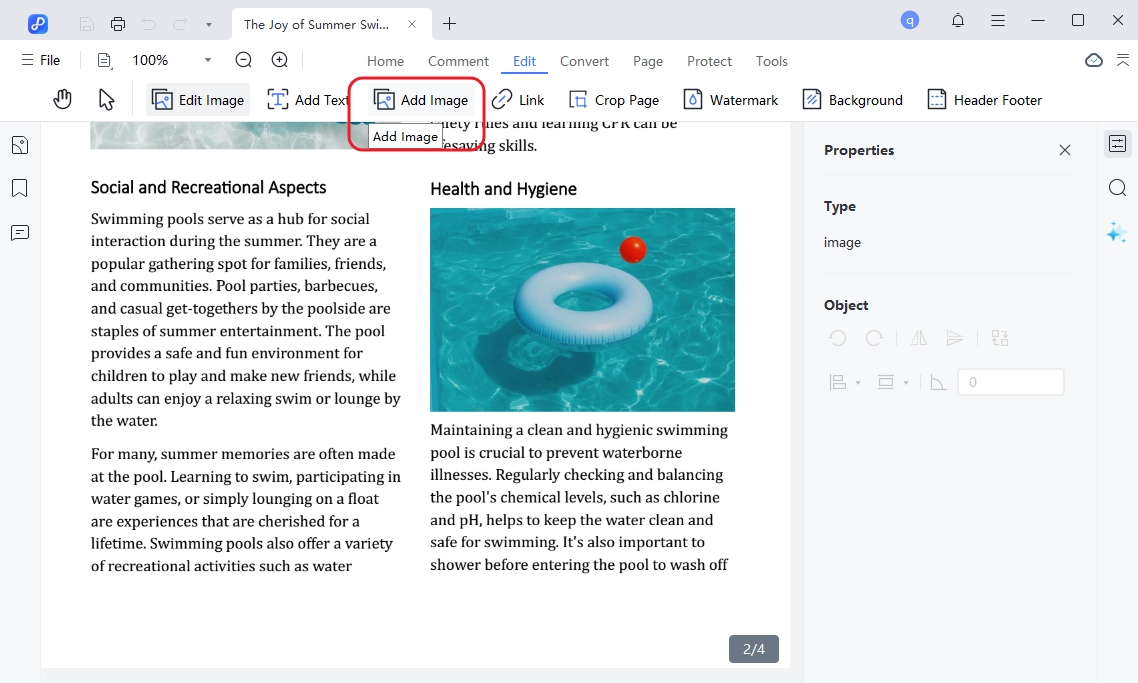

When dealing with adhesion contracts, making modifications or annotations can be essential. If you need to edit such agreements freely, tools like Tenorshare PDNob offer a straightforward way to adjust text, add comments, or highlight key terms without hassle.

PDNob PDF Editor Software- Smarter, Faster, Easier

In the insurance industry, contracts of adhesion are prevalent, with insurers drafting policies that consumers must accept in their entirety or decline altogether. While these contracts offer convenience, they also come with significant risks for policyholders.

Insurance companies rely heavily on adhesion contracts to streamline their policy agreements. These contracts are standardized, pre-written policies that customers must accept without negotiation. When purchasing auto, home, health, or life insurance, policyholders agree to the insurer’s terms, including coverage limits, exclusions, and claim procedures.

These contracts often contain complex legal language that may be difficult for the average person to fully understand. A key characteristic of adhesion contracts in insurance is the presence of exclusions—specific conditions under which the insurer is not obligated to pay claims.

While adhesion contracts make it easier for insurers to manage policies at scale, they also pose several risks for policyholders:

Consider an auto insurance policyholder who files a claim after a car accident. The insurer denies the claim, citing a policy clause that excludes coverage for accidents occurring in specific high-risk areas. Since the contract was non-negotiable, the policyholder had no choice but to accept these terms when signing up.

Similarly, a homeowner may discover that their insurance policy excludes coverage for mold damage, even though it was not explicitly mentioned when purchasing the policy. This illustrates how adhesion contracts can create unexpected financial risks for policyholders who may not fully grasp the extent of their coverage.

While adhesion contracts are generally enforceable, there are certain circumstances under which they can be deemed invalid. Courts may invalidate a contract if it contains unfair terms, is too vague, or if there is evidence of fraud or misrepresentation.

A contract of adhesion may be considered invalid if it contains grossly unfair terms that heavily favor the stronger party while exploiting the weaker party. Courts may assess both procedural and substantive unconscionability.

Procedural unconscionability arises when important terms are hidden in fine print or when the weaker party has no meaningful opportunity to understand the contract before agreeing to it. Substantive unconscionability refers to the actual terms being excessively one-sided, making the agreement fundamentally unfair.

If a contract contains vague or misleading language that benefits the drafter, it may be deemed invalid. Courts generally interpret ambiguous clauses in favor of the weaker party, as the stronger party had the advantage of drafting the agreement. Contracts must be written in clear and precise terms to ensure fairness and prevent one party from exploiting the other through unclear provisions.

An adhesion contract may also be unenforceable if it includes hidden clauses that mislead or deceive the adhering party. If the stronger party intentionally includes misleading terms or conceals significant provisions, the contract may be considered fraudulent. Courts may rule such agreements invalid, especially if the deception results in significant harm to the weaker party.

Courts may refuse to enforce an adhesion contract if its terms contradict established public policy. Provisions that waive essential legal rights, impose unfair penalties, or restrict access to legal remedies in an unreasonable manner may be deemed unenforceable.

If a contract contains clauses that undermine consumer protection laws or fundamental legal principles, courts may strike down the entire agreement or specific provisions.

In some cases, previous court rulings influence the enforceability of adhesion contracts. Courts often rely on established legal precedents when determining whether a contract is valid. Additionally, consumer protection laws may provide specific safeguards against unfair adhesion contracts, ensuring that businesses cannot impose unjust terms on consumers.

While adhesion contracts are widely used in various industries, they must still adhere to legal standards of fairness and transparency.

Adhesion contracts are nearly unavoidable in today’s world, but that doesn’t mean you have to accept them blindly. Whether you’re a consumer or a business, understanding how to protect yourself can help you avoid unfair terms and unexpected risks.

Before signing any adhesion contract, carefully read through the fine print, especially these key clauses:

While adhesion contracts are often "take it or leave it," there are cases where you can negotiate terms, especially in:

Even if changes aren’t always possible, asking for modifications shows the other party that you're paying attention and want fair terms.

If a contract seems one-sided or unclear, consult a legal expert before signing. Lawyers can:

For high-stakes contracts, such as long-term leases, business partnerships, or employment agreements, professional advice is crucial.

By staying informed and proactive, you can navigate adhesion contracts with confidence and avoid potential pitfalls.

If you find yourself needing to edit or amend an adhesion contract, using a reliable PDF editor can be a useful tool. Tenorshare PDNob allows users to easily modify and update documents, including contracts of adhesion, giving you greater control over your legal agreements.

Whether it's to clarify terms, remove ambiguous clauses, or add additional provisions, this tool offers a user-friendly interface for making necessary adjustments. The ability to edit contracts directly can be especially helpful for businesses or individuals dealing with non-negotiable agreements.

In insurance, adhesion means the policy is drafted by the insurer, and the consumer can only accept or reject it without changes.

Adhesion contracts are non-negotiable, standard agreements. Aleatory contracts depend on uncertain events, like an insurance payout.

A common example is a software license or insurance policy, where the terms are set by one party.

Yes, if they are fair and clear. Courts may refuse to enforce them if they are overly one-sided.

It means using a standard, take-it-or-leave-it contract, common in mass-market agreements, with no room for negotiation.

In conclusion, contract of adhesion are prevalent in the insurance industry, and while they offer a streamlined process for both insurers and consumers, they can also introduce significant risks. Understanding the enforceability of these contracts, knowing when they may be deemed invalid, and taking steps to protect your rights is crucial for policyholders.

With tools like Tenorshare PDNob , you can manage, edit, and review these contracts with ease. By staying informed and vigilant, you can ensure that you are not taken advantage of when entering into an adhesion contract.

PDNob PDF Editor Software- Smarter, Faster, Easier

then write your review

Leave a Comment

Create your review for Tenorshare articles

By Jenefey Aaron

2025-04-14 / Knowledge

Rate now!